A British billionaire with links to offshore tax havens and a history of controversial political donations has been granted New Zealand residence, and he’s been meeting with government ministers in Wellington.

Peter de Putron had a packed schedule for his trip to Wellington late last year. At 10am on Monday, December 2, the British billionaire met with Todd McClay in the forestry minister’s office at the Beehive, then was back at parliament at 2pm to catch up with finance minister Nicola Willis. That evening, he had dinner with science, technology and innovation minister Judith Collins at Jardin Grill at the Sofitel Wellington (Shed 5, the first choice, was booked out). At 11am the next morning, he returned to parliament for a meeting with associate finance minister David Seymour.

Four ministers in 25 hours.

De Putron’s meeting with Seymour the following morning had been set up by Lewis, who emailed Seymour’s deputy chief of staff on October 10. “Wondering if David would be keen to meet if schedules align (its less ministerial and more as ACT leader)?” he wrote. “It would be purely a meet and greet but Peter [redacted text] so could have some insights that might be of interest to David… He expects to significantly expand his New Zealand investments over the next few years, and is building a portfolio across multiple sectors and regions.”

“Significantly expand his New Zealand investments” is a line that is likely to have made Seymour’s eyes light up.

Just two days after Lewis reached out, Seymour announced a shake-up of our overseas investment policy settings, which he said were “the worst in the developed world” – so restrictive that wealthy offshore investors were giving New Zealand the cold shoulder, he lamented. Change was coming, though: a shake-up of the Overseas Investment Act to fast-track the assessment process, with “yes” being the default message sent to international investors unless a clear risk to New Zealand was identified.

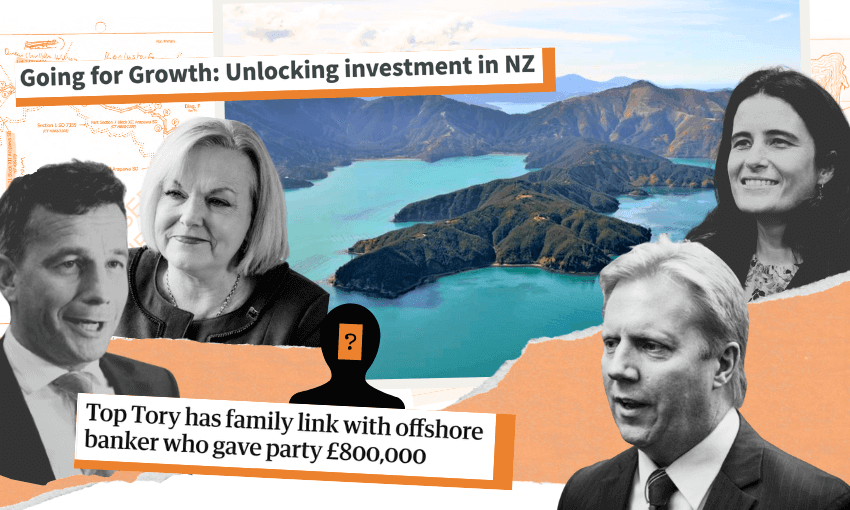

Often described as secretive, de Putron keeps out of the public eye. While his wife Hayley de Putron pops up in society snaps with the likes of Carole Middleton (mother of Catherine, Princess of Wales), not a single photo of him can be found online, but he has links to everything from Formula 1 (US court documents suggest he is the ultimate owner of the Williams F1 team, with employees referring to him as ODL or “our dear leader”), to fuel to, in New Zealand at least, forestry.

According to the MPI briefing prepared for McClay, de Putron is the sole shareholder of a company called New Zealand Forest Industries (NZFI) Ltd, through which he owns 830 hectares of commercial pine forest and 230 hectares of native bush in the Marlborough Sounds. Overseas Investment Office documents released to The Spinoff, however, suggest his land holdings total closer to 1,780 hectares. According to the documents, de Putron acquired NZFI Ltd when his British Virgin Islands-registered holding company, Issoria Offshore Ltd, was granted permission to acquire NZFI Ltd’s Singapore-registered parent company, NZFI Sing, in July 2019. NZFI Ltd owned a 1,116-hectare forest at Te Whanganui/Port Underwood in the Marlborough Sounds known as Underwood Forest. Consent was also granted for the purchase of Hakahaka Forest, a smaller “bolt-on” block immediately next to Underwood. Later that year, two further consents were granted for NZFI Ltd to acquire another unnamed block adjoining Hakahaka, as well as Whataroa Forest across the bay.

With what’s looking likely to be a tightly fought election just over a year away, the quiet quest for influence over our elected officials is likely to ramp up, and de Putron will be far from the only cashed-up client working with lobbyists to secure a spot in the diaries of our leaders. Even if the mysterious billionaire does return to New Zealand to make his presence (and feelings) known to our politicians, we may never put a face to the name. While the caricature of globetrotting billionaires may often be one of headline-grabbing interjections and flamboyance, many of the most powerful – and effective – of their number prefer to operate as invisibly as possible.